By Jamie Anderson on

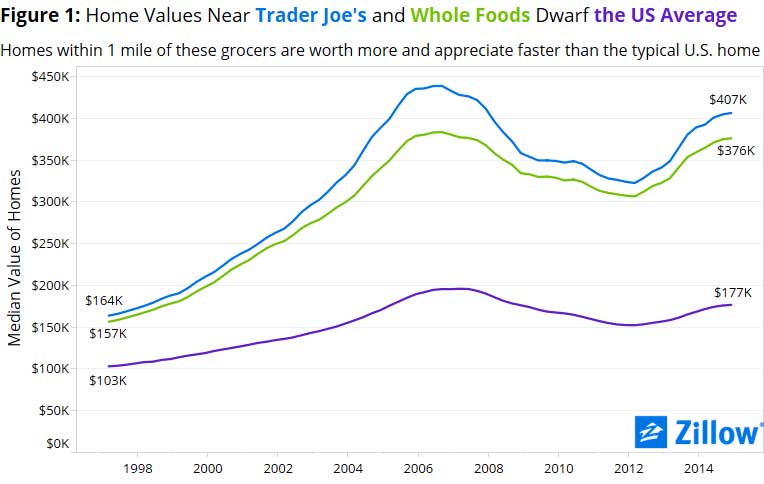

- At the end of 2014, homes located near a Trader Joe’s or Whole Foods had a median value of $406,600 and $376,200, respectively. At the same time, the median U.S. home was worth less than $180,000.

- Between 1997 and 2014, homes near a Trader Joe’s or Whole Foods appreciated an average of 148 percent and 140 percent, respectively. The typical U.S. home appreciated by 71 percent over the same period.

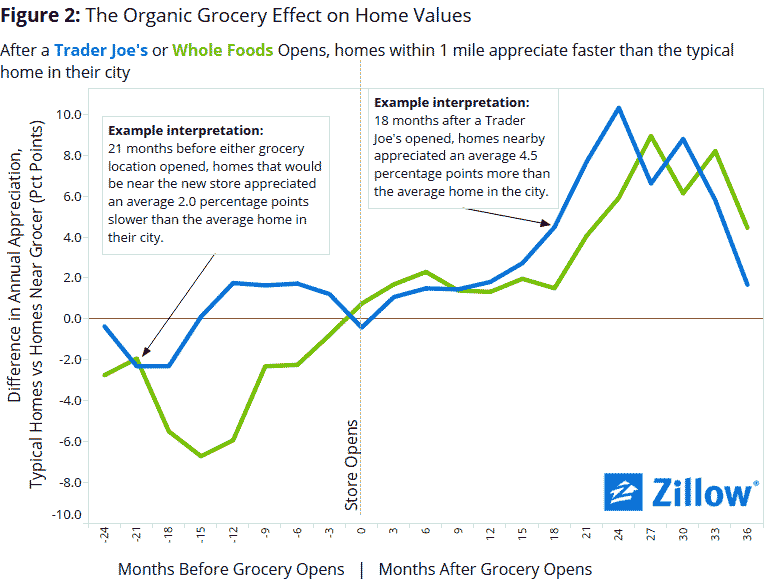

- Neither Whole Foods nor Trader Joe’s appears to be drafting off already hot neighborhoods. When factoring in store opening dates, homes near both chains began appreciating faster after the store opened than the typical home in their city overall.

We’ve proven that homes near a Starbucks appreciate more quickly and boost home value more than both the typical U.S. home and homes near rival Dunkin’ Donuts, giving you and your barista something interesting to discuss while your half-caff vanilla soy latte brewed. But what were you supposed to say to the cashier at Whole Foods when purchasing your favorite organic camel’s milk to top off your latte?

Don’t worry, Zillow Research has you covered. We’ve taken our Starbucks/Dunkin’ Donuts analysis and extended it to natural foods giants Whole Foods and Trader Joe’s.

Starting with the locations of 375 Whole Foods and 451 Trader Joe’s, we found all properties within a one-mile radius of each store.[1] There were a total of 1.5 million homes near a Whole Foods and 1.3 million near Trader Joe’s. Next, we tracked the median value of homes near either of these high-end natural food juggernauts by using historical Zestimate data. We found that the typical home near either of these chains both costs more and appreciates faster than the median U.S. home (figure 1).

The gap between home values near these stores and the typical U.S. home is even more pronounced than the effect we found for Starbucks. In general, homes near a Trader Joe’s were worth a median $406,600 at the end of 2014, and appreciated 148 percent between 1997 and 2014. Homes near a Whole Foods were worth a median $376,200, and appreciated 140 percent. The median U.S. home was worth $176,800 as of December 2014 and appreciated only 71 percent over the same time.

The fact that these stores are in high-cost areas shouldn’t surprise anyone, but the difference in appreciation rates is worth investigating further. Is this simply the result of a widening home value gap between high- and low-cost areas nationwide, or do Whole Foods and Trader Joe’s actually help accelerate home value growth?

To answer this question, we analyzed the appreciation rates of nearby homes both before and after a given Whole Foods or Trader Joe’s opened, relative to the appreciation of a more typical home in the same city. Thanks to a legion of diligent Mechanical Turk workers, we located the opening dates for 190 Whole Foods and Trader Joe’s stores nationwide. To ensure a long enough time series, we needed at least three years of Zestimate data surrounding the opening date, so any store that opened after 2012 or before 2000 was dropped.[2] That left us with 40 Trader Joe’s and 40 Whole Foods that fit our criteria.

The results are clear (figure 2)[3]. Before either a Whole Foods or Trader Joe’s location opens its doors, homes near the soon-to-be-opened store appreciated at the same pace or slower than the typical home in that city. Once these locations open, this relationship changes. Homes near either store begin to appreciate faster than the average home in the city.

Whole Foods and Trader Joe’s are not simply piggybacking off already hot neighborhoods. Rather, it appears both chains are either incredibly smart about finding neighborhoods on the verge of gentrifying, or the opening of either location positively impacts home values.

[1] For Starbucks we used a quarter-mile radius. The thinking is that you are willing to travel farther on your weekly grocery trip than for a cup of coffee.

[2] Historical Zestimates are generally available from 1997 onward.

[3] Note that appreciation at a given point in time is backward looking, so appreciation at -24 months is the net appreciation difference that took place 3 years before the store opened and 2 years before the store opened.

ABOUT THE AUTHOR

Jamie Anderson is a Data Scientist at Zillow.